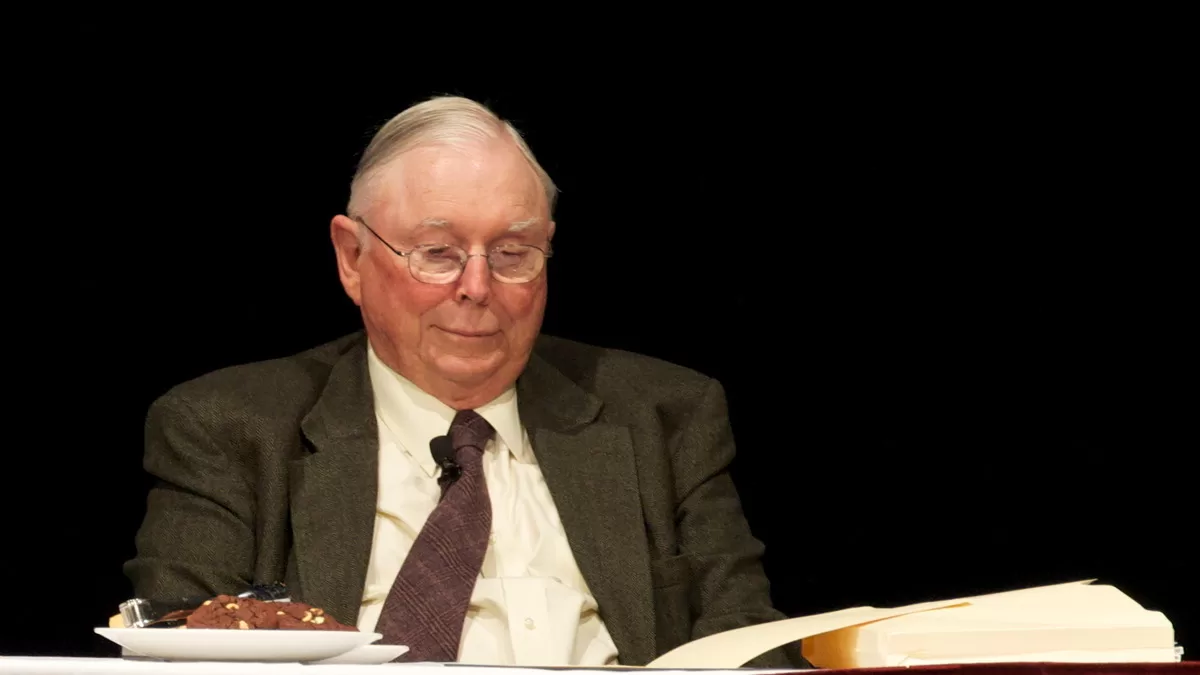

Charlie Munger, the venerable vice chairman of Berkshire Hathaway and a billionaire philanthropist, leaves behind a legacy of unparalleled wisdom and investing acumen.

Known for his sharp intellect and insightful perspective, Munger, who worked closely with Warren Buffett, passed away on Tuesday night in California at the age of 99.

Born on January 1, 1924, in Omaha, Nebraska, Munger’s journey was marked by intellectual curiosity from an early age. After graduating in mathematics from the University of Michigan in 1949 and obtaining a law degree from Harvard University in 1948, Munger initially pursued a career in law, eventually founding his own firm.

However, a pivotal moment occurred in 1959 when he crossed paths with Warren Buffett, leading to a legendary partnership that shaped the investment philosophy of Berkshire Hathaway.

Renowned for his multidisciplinary approach to problem-solving, Munger drew insights from psychology, economics, and business. His speeches and writings were characterized by a unique blend of wit, wisdom, and unvarnished honesty, advocating for a broad understanding of various disciplines to make well-informed decisions.

Beyond his role at Berkshire Hathaway, Munger engaged in diverse business ventures and served on multiple company boards. His philanthropic endeavours, especially in education and healthcare, showcased his commitment to making a positive impact beyond the business realm.

Munger’s intellectual prowess, coupled with a pragmatic approach to investing and life, earned him acclaim as one of finance’s most respected figures. His annual letters to Berkshire Hathaway shareholders and speeches at events like annual meetings were eagerly followed by investors and business enthusiasts seeking insights into his distinctive perspective on success and decision-making.

Here are ten insightful quotes by Charlie Munger:

“The game of life is the game of everlasting learning. At least it is if you want to win.”

“The big money is not in the buying and selling… but in the waiting.”

“The iron rule of nature is that you get what you reward for. If you want ants to come, you put sugar on the floor.”

“The big money is not in the buying or selling, but in the waiting.”

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments.”

“Spend each day trying to be a little wiser than you were when you woke up.”

“If people weren’t so often wrong, we wouldn’t be so rich, Warren!”

“I think you would understand any presentation using the word EBITDA if every time you saw that word, you just substituted the phrase with ‘bullshit earnings.”

“I don’t like multi-tasking. I see these people doing three things at once and I think, God, what a terrible way that is to think.”

“Money management requires people to pretend they can do something that they can’t, and like it when they really don’t. I think that’s a terrible way to spend your life, but it’s very well paid.”

Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.