The only constant in business is change, and if there’s one lesson recent years has taught business leaders, it’s that businesses of all sizes must be prepared for anything. From global economic recessions to unforeseen market shifts, companies have been challenged time and again to adapt and pivot. Now, more than ever, the role of finance decision-makers is essential. Right now, leaders find themselves at the crossroads of opportunity and risk. How they respond to moments of uncertainty can make all the difference between success and failure. When thinking about steps like updating software, training employees, or starting a marketing effort, each cost can help the business grow. However, it’s important to note that every dollar spent could have been used in a different way. Making poor spending decisions can cause financial issues or even lead to the company shutting down. So, how do they lead with resilience? And, how can finance decision-makers equip themselves to make informed decisions when the stakes are so high? To make the most out of every spending choice, companies need a clear understanding of their financial landscape. There are some key strategies every business leader and finance decision-maker should have up their sleeve, including: Embrace moments of change The first step to resilience is acceptance. Recognise that change is inevitable and often comes unannounced. Whether it’s adjusting to new market demands, navigating shifts in workforce dynamics, or responding to external shocks, businesses need to be agile. The solution? Adopting tools that empower work changes. Modern solutions automate tedious tasks, letting employees focus on what they do best. As these tools evolve, businesses can reconfigure them to suit changing needs, ensuring continuity in operations. Capitalise on moments of decision Every decision, especially in finance, carries weight. Whether it’s reallocating budgets, investing in new ventures, or cutting down on non-essentials, these choices determine the trajectory of the company. To make these decisions confidently, finance leaders need transparency, integration, and perspective. A solution that offers insights powered by reporting tools, artificial intelligence (AI), and machine learning (ML) can simplify complex data, making decision-making more informed and effective. Seek moments of clarity The sheer volume and complexity of regulation, compliance, and tax regulations can often seem overwhelming. However, with the right tools, these tasks become more manageable. These automated solutions break down complex rules into actionable steps, helping businesses stay compliant and make informed decisions without getting overwhelmed. Harness the power of data integration Having a clearer business picture for decision-making requires integration with other vendors and systems. This means being able to seamlessly blend data from various sources to derive actionable insights. Whether it’s through cloud services, partner ecosystems, or application programming interfaces (APIs), ensuring that the chosen solution can integrate effectively is paramount. Prioritise user experience In the race to adopt the latest tools and technologies, user experience often takes a backseat. However, a solution that prioritises user experience, offering training, customer support, and a seamless interface across devices, ensures that all stakeholders, from employees to management, can leverage its capabilities to the fullest. Plan for scalability As companies grow, their needs evolve. There’s suddenly more data to handle, teams become larger, and workflows can get complicated. A solution that scales—in size, specialty, across countries and currencies—is invaluable. This adaptability ensures that the tools and processes that serve a business today will continue to serve it tomorrow. Educate and empower Resilience is as much about mindset as it is about tools. Equip teams with the knowledge and resources they need to navigate uncertain terrains. From implementing policies and approval processes to understanding the intricacies of the solution, continuous education empowers teams to make better, more informed choices. Leading with resilience In uncertain times, businesses need solid strategies for financial management. It’s not just about mitigating risks, it’s also about identifying and seizing opportunities. Whether it’s choosing to invest in a new venture, reallocating budgets, or ensuring compliance with evolving regulations, each decision must be underpinned by clarity, transparency, and foresight. To address spending decisions, companies of all sizes should consider automating their financial processes. Implementing automated systems for travel, expenses, and invoicing provides a comprehensive approach to manage every expenditure, paving the way for a brighter future for the business. By streamlining spending processes, companies can operate efficiently anywhere, anytime, and in any situation. With the right tools, finance decision-makers can control each financial decision. Investments in technology, marketing, or employee training can then directly contribute to long-term success, and a stronger future. Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

The latest Employment Hero SME Index, which uses an accumulative dataset of over 150,000 small and medium-sized businesses (SMEs) and 1.5 million employees, reveals Australia’s wage growth is beginning to flatten to align with inflation, prompting CEO Ben Thompson to call for a near term halt in further interest rate increases by the Reserve Bank of Australia (RBA). Wage growth aligns with inflation The SME Index for October revealed that the monthly median hourly rate marginally increased by 0.5 per cent, a modest change compared to earlier months in the latest quarter, which saw a 2.8 per cent rise. Average employee growth also saw a marginal increase of 0.1 per cent month-on-month (MoM), with a quarterly change of 0.8 per cent. This real-time development in wage growth paired with an ongoing decrease in employee growth rates marks a potential turning point in the nation’s economic trajectory. Ben Thompson, Co-founder and CEO of Employment Hero, asserts that as wage growth becomes more in line with inflation, Australian workers should be spared from further cash rate increases. Mr. Thompson said: “The RBA’s recent fears of a wage-price spiral were previously indicated in our June Index, something we could identify due to the real-time granularity of our data. However, our latest October data now reflects the critical alignment of wage growth with inflation. We’re almost certain that Aussies will be spared further cash rate rises for the remainder of this year. In fact, we would strongly encourage the RBA to hold tight on further interest rate increases. “As we expect this plateauing wage trend to continue in 2024, Australian businesses and workers should receive a breather over the holiday season if the Reserve Bank pays attention to the data and pauses rate rises in at least the short term,” Mr. Thompson added. While the SME Index for October shows a flattening in wage growth, it also highlights a surge in healthcare hiring ahead of a predicted rise in COVID outbreaks over the holiday season and the notable return of older workers to the workforce. Healthcare sector ramps up hiring ahead of COVID season According to the SME Index, Healthcare and Community Services showed the most significant increase in hiring across all industries. The sector observed a 1.2 per cent quarterly increase in average employee growth and an 8.8 per cent increase year-on-year (YoY). This outpaced other key industries, including Construction and Trade Services; Manufacturing, Transport and Logistics; Retail, Hospitality and, Tourism, and; Science, Information and Communication Technology, which all recorded below one per cent in quarterly increases. This trend aligns with expectations of a seasonal COVID outbreak, with recent NSW Health data detecting COVID cases in NSW soaring more than 20 per cent in the past fortnight amid a national spike in vaccination rates, leading experts to believe there’s concern over a “Covid Christmas.” Healthcare and Community Services additionally saw the greatest increase in the median hourly rate of all industries, rising 1.3 per cent MoM, 3.8 per cent quarterly, and eight per cent YoY. The data indicates the Healthcare sector continues to bear the brunt of talent shortages, causing wages to grow faster than other industries. Older workers re-enter the workforce A surprising trend in the latest SME Index is the significant return of older workers to the workforce over the past year. The 65+-year-old age group experienced an 8.6 per cent increase in the median hourly wage rate compared to October 2022. This increase surpasses that of other age groups, including Under-18-year-olds at eight per cent, 18-24-year-olds at 6.5 per cent, and 25-65-year-olds at 7.3 per cent. The data suggests that cost of living pressures may be a driving factor for this demographic’s return to work, particularly now in the lead-up to Christmas. Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

New research from YouGov commissioned by ANZ has shown that 90% of Australians have made adjustments to their spending habits in the last six months. The most common ways that Australians are making changes include looking for cheaper alternatives when grocery shopping (59%), eating out less (56%), getting fewer takeaways (55%), and shopping for/at cheaper brands (49%). Making coffees at home instead of buying coffee from a café (37%), taking homemade lunches to work (35%), and delaying holiday plans (33%) are other changes being implemented by people to try and take control of their finances. The YouGov research, commissioned by ANZ, revealed interesting patterns when it comes to credit card usage, with the most common reasons people cite using a credit card being for emergencies (44%) and to help manage cash flow (36%). The study was conducted in line with a new feature ANZ has recently launched on their credit cards – ANZ Instalment Plans – which allows eligible customers to buy now and repay later by making a credit card purchase and repaying it at a pace that suits them – by choosing to repay in Instalments of 3, 6 or 12 months. ANZ Instalment Plans allow customers to enrol an eligible Purchase onto a Plan and pay 0% p.a. interest for the term of the Plan, whilst paying a Setup Fee (which is charged up front and payable over the life of the Plan). Without taking into account any fees or charges associated with instalment plans, 66% of Australians surveyed indicate they would use an instalment plan to repay their credit card purchases – but 30% remain unaware that such an option exists on credit cards. While just over half of Australians (51%) say that the optimum period of repayment for them would be under 6 months, as they seek financial wellbeing in a difficult economic climate. Many would use an instalment plan (not taking into account fees or charges associated with them) to pay for emergencies or essentials including unexpected medical or vet expenses (23%), car repairs or maintenance (19%), groceries (17%), and school or university fees/tuition (9%). The research also showed flexibility around purchasing bigger items, such as whitegoods, furniture, home appliances (22%), and home repairs, maintenance, renovation (16%) make instalment repayments appealing. Key research findings: Nine in 10 (90%) Australians aged 18-60 are cutting back on their spending, while 48% of Australians have been living on a strict budget in the last six months. Without taking into account any fees or charges associated with instalment plans, two in three (66%) Australians aged 18-60 say they would use an instalment plan to repay their credit card purchases. A good rewards program was the biggest reason why young users aged 18-34 chose their primary credit card (41%), while a low annual fee was the biggest reason amongst older users. ANZ Wealth Adviser, Liana Cauchi, said: “It’s clear from the research that many Australians are adjusting their spending and saving habits according to the current financial climate. ANZ Instalment Plans were introduced to provide ANZ credit cardholders with a manageable way to buy and repay unexpected purchases and work towards financial wellbeing. Having the option to be able to pay back credit card purchases over instalments can be a great benefit to our customers.” “We know the difficulties that many are facing when it comes to both everyday items and those larger unexpected expenditures, so this is another tool that might assist with monthly budgeting. Our customers are needing assistance when it comes to cash flow management and Instalment Plans have been introduced to ANZ credit cardholders as an option that might help with that.”For more information visit: https://www.anz.com.au/personal/credit-cards/instalment-plans/ Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

CommBank’s innovation arm, x15ventures, has declared Pairtree Intelligence the winner of its 2023 Xccelerate program. Revealed during the bank’s tech and innovation update in Sydney, the collaboration will see Pairtree working closely with CommBank to enhance and reshape its offerings within the agricultural sector. Established in 2018, Pairtree simplifies data management for farmers by integrating information from over 100 AgTech sources, providing a comprehensive view of farm operations and supply chains. The collaboration aims to leverage Pairtree’s expertise to better understand agribusinesses, using farm data to inform product and service improvements. This partnership aligns with Australia’s focus on AgTech adoption for sustainable and resilient agricultural practices. The initiative will contribute to refining lending processes, enhancing risk decision-making, and supporting the transition to a net-zero future. About Xccelerate 2023 Xccelerate, now in its fourth year, serves as a platform for early-stage founders to explore partnerships with CommBank. This year’s program, focused on startups facilitating Australia’s move towards net zero, attracted applications from over 70 teams—an impressive 40% increase from the previous year. The Xccelerate winner not only receives investment from x15 but also gains mentorship and resources to navigate a partnership agreement with CommBank. As part of x15, CommBank’s venture scaler, x15ventures was founded in 2020 to build, buy, and invest in startups that could enhance the lives of the bank’s 15 million customers. The overarching goal is to reimagine existing products and services, extending the bank’s relationship and relevance by embracing innovative solutions beyond traditional finance offerings. Toby Norton-Smith, Managing Director, said: “Reaching net-zero will require trillions of dollars of lending and investment – plus a step change in how consumers and businesses meaningfully understand and address this challenge. Banks have a big role to play in that transition, and this year’s Xccelerate has been a great way for early-stage ventures to explore the enterprise opportunity.” “While we had a record number of applications for this year’s Xccelerate, we were particularly impressed with Pairtree’s macro solution that doesn’t ‘pick winners’ in the AgTech space, but rather focuses on how the influx of data created by the burgeoning world of IoT and digital services can help farmers – and banks that lend to them – make smarter decisions.” “I’m pleased to say that almost all of our Xccelerate finalists are in ongoing conversations with different parts of the bank” Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

Welcome to AI Weekly, where we delve into the cutting-edge and ever-evolving world of artificial intelligence and bring you concise yet comprehensive summaries of the most exciting AI developments. Global Surge in Interest for OpenAI’s ChatGPT on Google Breaks Records The demand for generative artificial intelligence (AI) tools is witnessing an unprecedented surge, with OpenAI’s ChatGPT leading the way. Recent data from Finbold indicates a remarkable 400% increase in global Google searches for ‘ChatGPT’ in 2023, reaching a peak popularity score of 100 on November 5. Over the past 12 months, the demand has skyrocketed by an astounding 9,900%, reflecting the growing appetite for this innovative AI model. Breaking down the popularity by country, China takes the lead with a score of 100, followed by the Philippines and Nepal sharing the second position with 32. Singapore and Sri Lanka tie for the third spot with a score of 31. Other countries displaying significant interest include Pakistan (29), Kenya (25), Lebanon (25), Tunisia (24), and Morocco (23). Salesforce and Amazon Deepen Partnership to Enhance AI Capabilities Salesforce and Amazon Web Services have expanded their partnership to simplify data management across both platforms. The enhanced agreement aims to seamlessly integrate generative AI technologies into applications and workflows. This collaboration enables customers to securely manage data across Salesforce and AWS while responsibly incorporating the latest generative AI advancements into their processes. TaxLeopard Acquires Airtax in a Strategic Move for Growth and AI Integration TaxLeopard, the Australian accounting software and tax app, has acquired Airtax, a BAS and income tax return lodging software. This strategic move, valued at six figures, allows TaxLeopard to absorb Airtax’s user base and strengthen its presence in the rideshare market. The acquisition aligns with TaxLeopard’s growth plans, marking a significant step in scaling its user network, technological infrastructure, and partnerships. Additionally, it serves as a catalyst for increased research and development, as TaxLeopard looks to integrate generative AI technology for more nuanced and automated tax solutions. Symphony Collaborates with Google Cloud for Advanced Financial Voice Analytics Symphony, a leading markets infrastructure and technology platform, is partnering with Google Cloud to enhance its financial markets voice analytics. Leveraging Google Cloud’s gen AI platform, Vertex AI, Symphony aims to offer high-accuracy voice analytics through speech-to-text fine-tuning and natural language processing (NLP) capabilities. This collaboration builds upon Symphony’s existing partnership with Google Cloud as its primary cloud provider. Leonardo.Ai’s Remarkable Milestone: 700 Million Images Generated on AWS Leonardo.Ai, an Australian generative AI content production platform, has achieved a significant milestone by generating over 700 million images and training more than 400,000 custom generative AI models on AWS. In less than a year, the startup has transformed content creation, providing users with the ability to generate hyperrealistic images suitable for various industries. The move to AWS facilitated efficient management of continuous user growth, ensuring resiliency, security, and scalability. Abu Dhabi’s Advanced Technology Research Council Launches AI71 In the dynamic field of artificial intelligence, Abu Dhabi’s Advanced Technology Research Council (ATRC) introduces AI71, a new AI company. Building on the Technology Innovation Institute’s Falcon generative AI models, AI71 focuses on multi-domain specializations and offers unprecedented AI data control options. The company aims to empower companies and countries with self-hosted AI for enhanced privacy and control in an era of rapid AI advancements. Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

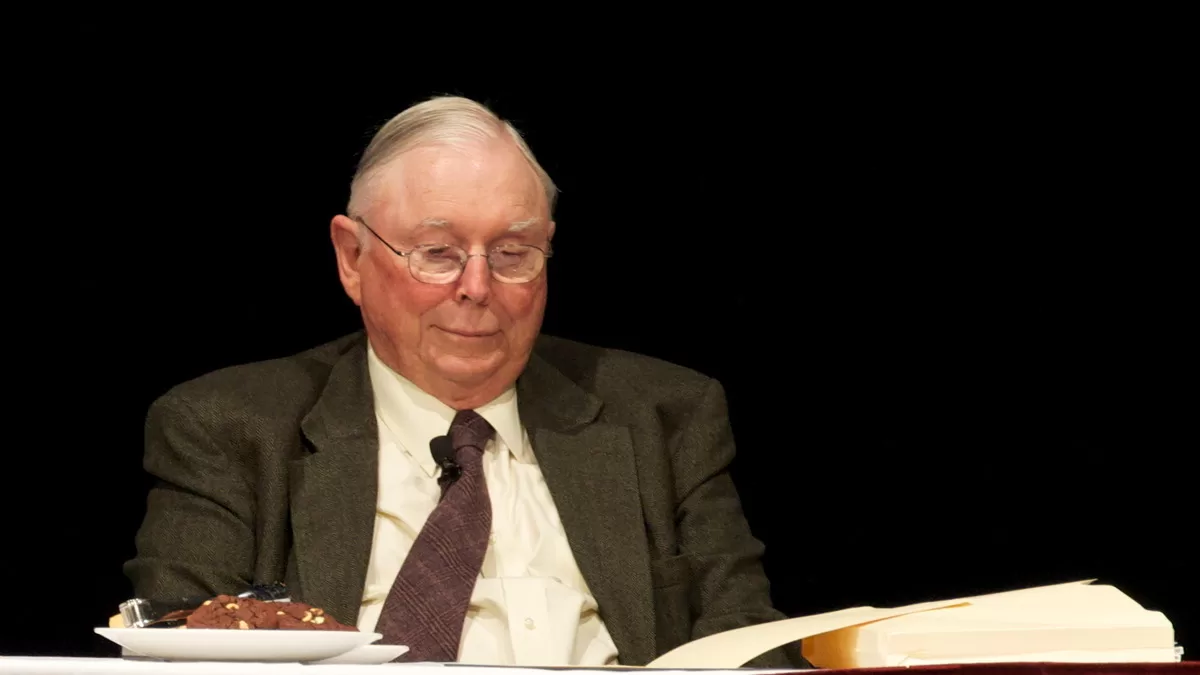

Charlie Munger, the venerable vice chairman of Berkshire Hathaway and a billionaire philanthropist, leaves behind a legacy of unparalleled wisdom and investing acumen. Known for his sharp intellect and insightful perspective, Munger, who worked closely with Warren Buffett, passed away on Tuesday night in California at the age of 99. Born on January 1, 1924, in Omaha, Nebraska, Munger’s journey was marked by intellectual curiosity from an early age. After graduating in mathematics from the University of Michigan in 1949 and obtaining a law degree from Harvard University in 1948, Munger initially pursued a career in law, eventually founding his own firm. However, a pivotal moment occurred in 1959 when he crossed paths with Warren Buffett, leading to a legendary partnership that shaped the investment philosophy of Berkshire Hathaway. Renowned for his multidisciplinary approach to problem-solving, Munger drew insights from psychology, economics, and business. His speeches and writings were characterized by a unique blend of wit, wisdom, and unvarnished honesty, advocating for a broad understanding of various disciplines to make well-informed decisions. Beyond his role at Berkshire Hathaway, Munger engaged in diverse business ventures and served on multiple company boards. His philanthropic endeavours, especially in education and healthcare, showcased his commitment to making a positive impact beyond the business realm. Munger’s intellectual prowess, coupled with a pragmatic approach to investing and life, earned him acclaim as one of finance’s most respected figures. His annual letters to Berkshire Hathaway shareholders and speeches at events like annual meetings were eagerly followed by investors and business enthusiasts seeking insights into his distinctive perspective on success and decision-making. Here are ten insightful quotes by Charlie Munger: “The game of life is the game of everlasting learning. At least it is if you want to win.” “The big money is not in the buying and selling… but in the waiting.” “The iron rule of nature is that you get what you reward for. If you want ants to come, you put sugar on the floor.” “The big money is not in the buying or selling, but in the waiting.” “A lot of people with high IQs are terrible investors because they’ve got terrible temperaments.” “Spend each day trying to be a little wiser than you were when you woke up.” “If people weren’t so often wrong, we wouldn’t be so rich, Warren!” “I think you would understand any presentation using the word EBITDA if every time you saw that word, you just substituted the phrase with ‘bullshit earnings.” “I don’t like multi-tasking. I see these people doing three things at once and I think, God, what a terrible way that is to think.” “Money management requires people to pretend they can do something that they can’t, and like it when they really don’t. I think that’s a terrible way to spend your life, but it’s very well paid.” Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

In October 2023, Australian retail turnover experienced a decline of 0.2%, as revealed by seasonally adjusted data released today by the Australian Bureau of Statistics (ABS). This downturn follows increases of 0.9% in September 2023 and 0.2% in August 2023. According to Ben Dorber, ABS head of retail statistics, the dip in retail turnover in October can be attributed to a temporary surge in spending observed in September. Dorber stated, “Turnover decreased across all retail categories except for food retailing. It seems consumers paused discretionary spending in October, likely holding off for Black Friday sales events in November—a trend observed in recent years as Black Friday sales gain popularity.” Notably, food retailing experienced a positive trend, recording a 0.5% increase this month. Conversely, all non-food retail industries saw a decline in October, reversing the gains from the previous month. The largest fall among non-food industries was in clothing, footwear, and personal accessory retailing (-1.0%), followed by household goods retailing (-0.6%), department stores (-0.6%), and other retailing (-0.4%). Cafes, restaurants, and takeaway food services also experienced a second consecutive decline (-0.4%). Dorber commented, “Spending in these establishments has slowed recently due to rising food prices and cost-of-living pressures, bringing it back to a level similar to that seen in July 2023.” The growth in retail turnover showed a varied pattern across the country, with five states and territories witnessing a decrease. Victoria (-0.8%), New South Wales (-0.5%), and the Australian Capital Territory (-0.5%) each reported their first monthly decline in retail turnover since June 2023. CreditorWatch’s Chief Economist, Anneke Thompson said: “Retail sales fell an overall 0.2 per cent over the month of October, after recording rises in spending in both preceding months. For discretionary goods categories, this is to be expected, as many consumers will have chosen to hold off on spending for Black Friday sales, which are currently in progress. We expect that all categories of goods spending will see a good lift in spending in November due to these sales, following patterns that have emerged in recent years.” “The area of spending that is not impacted by Black Friday, cafes, restaurants and takeaway food services, recorded a second straight fall in spending, after bucking the trend in other discretionary categories for many months. Spending in this category fell by 0.4 per cent and is now back to July 2023 levels. This indicates that consumers have finally started to pull back on dining out, in the face of cost-of-living pressures and rising interest rates. “What is concerning is that this sector already well and truly tops the rankings for external administrations by Industry. In the 12 months to December 2023, one in 100 food and beverage services businesses went into external administration. There are now rising headwinds in this sector, as demand falls, the ATO calls in large GST and other tax debts, and labour, rent and energy costs all continue to rise. The food and beverage sector is also the second highest ranked industry for payment arrears (behind construction), with 9.3 per cent of total invoices more than 60 days in arrears.” Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

The government is set to fast-track numerous industrial relations (IR) amendments through Parliament without proper consultation. This move raises concerns among major Australian employer groups, as over one hundred amendments are expected to be introduced hastily, leaving insufficient time for debate and scrutiny. Amidst a cost-of-living crisis, the proposed changes are deemed problematic for businesses and workers. The government’s secretive approach, making amendments without public disclosure until the last minute, adds to the concerns of employer groups. Despite reported adjustments, the Bill remains confusing, complex, and costly. Key issues include the potential impact on up to 2.7 million casual employees, higher prices for food delivery services, expanded union entry rights, increased complexity for small businesses, erosion of self-employment rights, and potential litigation challenges. The call for an extension of the Senate Committee Report into the Fair Work Amendment (Closing Loopholes) Bill reflects the need for thorough investigation and public scrutiny. Australian employer groups stress the importance of splitting non-controversial bills with widespread support, urging the government to genuinely address concerns and engage transparently to find effective solutions. In a press release, the government said: “The current policy will hit Australian businesses and workers with more costs and complexity right in the middle of a cost-of-living crisis. To deal with criticism of the Bill, the Government has been making amendments, hiding them from the public and we only expect them to be finally released on Tuesday afternoon, giving MPs no time to scrutinise the detail before being asked to accept it. These changes will affect every business and every worker, and rushing amendments without proper consultation will do nothing more than tinker at the edges of the 800 pages of legislation. “All the major problems with the Bill still remain and the changes, reported in recent weeks, do nothing to allay our significant fears. In fact, the Bill remains confusing, complex and costly. Unfortunately, we, Australian’s leading employer groups, believe the Government is unwilling to listen to any views which they do not agree with. The Bill will: Impact up to 2.7 million casual employees with less flexible jobs and the loss of 25% loading income; Push up prices for food delivery services to consumers; Expand the circumstances in which unions can enter workplaces without prior notice; Impose complexity, confusion and red tape onto small businesses who are already under enormous operating pressures; Erode the right for self-employed Australians – from barbers to builders – to be their own boss; This means two workers with vastly different levels of experience will be forced to be paid the same; Increase costs and reduce the availability of road transport services; Embroil service contractors in all industries in costly litigation regarding “Same Job, Same Pay;” Increase the cost of building a home in the middle of a housing crisis. “We also reiterate our support for splitting the four non-controversial bills, which have widespread support from the crossbench and Coalition in both houses of Parliament. We urge the Government to genuinely listen to the concerns of businesses and workers to identify the issues it is really seeking to resolve, and engage openly and transparently to find solutions.” Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

Four in five SMEs now partner with more than one lender for their working capital needs, with specialised services including Invoice Finance, Asset Finance and Trade and Supply Chain Finance, prompting more businesses to look beyond their main relationship bank. The preparedness of SMEs to work with multiple lenders contributed to the preference for non-bank lending remaining at an all-time high of 47%, which is double the rate of March 2022. The key findings come as a healthy 61% of SMEs stated they plan invest in their business in the next six months – a 15% jump year-on-year – and the highest level of investment intent recorded since 2019. The insights are contained in the latest round of the country’s longest running SME pulse check, the bi-annual SME Growth Index by ScotPac, Australia’s leading non-bank business lender. When asked to expand on their approach to secondary working capital relationships, SME owners and operators provided the following feedback: 67% nominated ease of credit approval as the leading factor for choosing a secondary provider. 37% rated higher credit limits a top three factor when assessing non-bank lenders. 60% of SMEs that do not have a secondary lender said that jumping through the onboarding hoops of a new provider was ‘all too hard’. Of those SMEs intending to invest for growth in the next six months, a considerable figure of 15% said they were unsure of how to fund new business investment. ScotPac CEO, Jon Sutton, said the high level of investment intent, combined with the appetite of SME owners to explore the lending market, emphasised the need for businesses to maintain a strong relationship with their broker. “Despite the macroeconomic headwinds of rising wages, stubbornly high inflation and uncertainty about interest rates, Australian SMEs are continuing to invest in their businesses at near record levels,” Mr Sutton said. “While some of that growth can be attributed to higher input prices, the strength of SME investment intent goes beyond this factor alone. An emerging driver is choice. Non-bank lending has doubled in the past 18 months as SME owners and brokers have become increasingly aware of the opportunity to find fast, flexible and tailored working capital solutions, with easier onboarding than ever. “With a large number of SMEs intending to self-fund their growth plans, or still unsure of how to fund new investment, there are some great opportunities in the current market for brokers to help thousands more SMEs while growing their own business,” Mr Sutton said. Mr Sutton said ScotPac has the breadth of products and experience to support more SMEs in more situations than any other non-bank lender, and its technology-enabled platform made it faster and easier than ever for SMEs and brokers to find the right solution. “Speed, ease and simplicity remain the key decision drivers for business owners when choosing a secondary working capital provider,” Mr Sutton said. “Whether SMEs are looking to invest in assets, inventory or expertise, ScotPac has the tools and the team on hand to quickly deliver a package to match their needs.” About the SME Growth Index: Sectors represented in the survey included Manufacturing (14%), Property & Business Services (14%), Retail (11%), Wholesale (12%), Personal and other Services (10%), Construction (10%) and other industries including Transport & Storage, Mining, Agriculture, Media, Hospitality, Finance & Insurance (non-bank) and Electricity. Keep up to date with our stories on LinkedIn, Twitter, Facebook and Instagram.

In the fast-paced and ever-evolving landscape of modern business, the intentional use of data analytics emerges as a crucial asset for making well-informed decisions. Providing organisations with a unique perspective, data analytics enables the meticulous examination and interpretation of extensive datasets, ultimately converting them into actionable insights. This edition is designed to simplify the intricacies of this process, offering an inclusive guide on utilizing data analytics to elevate business intelligence. Join us as we delve into the current instalment of “Let’s Talk,” where our experts dissect the nuances of deploying data analytics effectively, allowing businesses to glean priceless insights into their operations. Let’s Talk. Discover more Let’s Talk Business episodes Contribute to Dynamic Business Liz Adeniji, Regional Vice President, APJ at Twilio Liz Adeniji, Regional Vice President, APJ at Twilio “In today’s competitive business landscape, understanding and responding to customer needs is paramount. However, many businesses grapple with disjointed data, often siloed within various departments and systems, making it challenging to gain valuable insights and create cohesive customer experiences. Businesses today are aware of the need to put the customer at the heart of their business, and to deliver that promise, they can leverage insights from data analytics to unlock personalisation. “Twilio’s research found that real-time personalisation, made possible by a unified view of their customers, boosts customer lifetime value, with 79% of Australian consumers saying personalised experiences increase brand loyalty. On average, Aussie consumers spend 19% more on brands that personalise. “Being able to collect, centralise and standardise customer data allows businesses to break down silos, enabling a unified view of the customer. The emergence of predictive AI takes this a step further and adds a deeper dimension to personalisation. AI can anticipate customers’ needs and next actions, allowing brands to tailor their engagement better and respond to each customer as a true individual, not just a member of a cohort. Brands can tap into AI to help create the most relevant customer journey for each individual, tailoring the next offer and outreach based on a nuanced understanding of that person’s past interactions, their preferences, and their likelihood of connecting with each offer. “Data analytics is a powerful tool for businesses to better understand their customers. By addressing data silos and harnessing AI’s capabilities, brands can gain valuable insights on their customers and digitally deliver the kind of personalised experience traditionally associated with a local store.” David Walsh, CEO and Founder at CIM David Walsh, CEO and Founder at CIM “In the world of commercial property operations, a robust monitoring approach centred around data and analytics is the key to informed decision-making and improved performance. By unleashing the power of existing building data, intelligent automation, and machine learning, owners can boost visibility and control over their portfolios while improving efficiency, sustainability, and tenant comfort. “The technology that enables this is available today. Software containing vast libraries of advanced algorithms can continuously monitor all building equipment to immediately identify any failure, major anomaly or tuning opportunity. “The integration of analytics allows for a deep dive into operational data, revealing opportunities to optimise energy use, streamline maintenance schedules, and improve tenant conditions. Such targeted insights can lead to cost savings, improved tenant retention, and higher property values. “Analytics also enables data-driven maintenance, the integration of advanced AI-powered analytics into the realm of property maintenance. Unlike traditional strategies, which rely heavily on preset schedules or reactionary measures, DDM employs continuous data collection and analysis to guide maintenance decisions. “In the realm of commercial real estate, data analytics serves as a critical tool. It not only enhances day-to-day operations but also guides long-term decisions, ensuring that properties are not just well-maintained but also well-positioned for future success.” Andrew Rossington, Chief Product Officer at Teletrac Navman Andrew Rossington, Chief Product Officer at Teletrac Navman “Whether you are managing fleets of delivery drivers, mobile care providers or plumbers, effective fleet management relies on actionable data, and data analytics play a crucial role in helping fleet operations to optimise performance. “By capturing data from manufacturer-installed or dedicated devices, all fleet data can be aggregated into one platform in real time. With instant access to data through reporting, dashboards, and alerts, all team members can make quick, data-driven decisions. “Fleet management analytics not only streamlines fleet operations but also provides a competitive advantage. Analysis of key performance indicators such as equipment utilisation rates, idle times, and route efficiency, identifies opportunities to cut operational costs, eliminate underused assets, and boost overall productivity. “Improved fleet maintenance enables proactive and timely maintenance, which reduces breakdown risks, extends asset lifespan, and minimises costly repairs. Fleet data analytics also contributes to improved driver safety, identifying areas for improvement through driver scorecards and enabling targeted training programs. “Real-time data analysis enables proactive decisions about route optimisation and dispatching, directly impacting delivery times and reducing delays. This increased transparency improves customer satisfaction, loyalty, and overall company reputation. “Leveraging fleet data analytics transforms business operations by simplifying accessibility, fostering cross-functional collaboration, and enabling effective, data-driven decision making for improved performance. At Teletrac Navman, our customisable fleet management platforms with strong data aggregation and analytics tools are designed to enable new ways of working.” Nathan Pilgrim, Chief Information, Product and Strategy Officer at Gallagher Bassett Nathan Pilgrim, Chief Information, Product and Strategy Officer at Gallagher Bassett “Every business has a wealth of data available to them to better inform key decisions, and deliver outcomes that matter to their customers. However, the ability to harness this data, gain insights from it, and apply it strategically continues to be a challenge for many. At Gallagher Bassett, we have decades of data that provides insights into claims and risk management trends, service level expectations and how we can improve efficiencies. We have developed an approach where we partner subject matter experts, information architects, business intelligence developers and application developers to ensure insights from our data are available to our people. By democratising the access to data, we are able to deliver market-leading solutions, such as: Evidence based